How to Own Foreign Companies and Not Have Problems with Tax Authorities in Russia. Guide to Controlled Foreign Companies

• The second edition of the specialized Guide to Working with Controlled Foreign Companies (CFC) by a team of authors from the law firm GSL Law and Consulting.

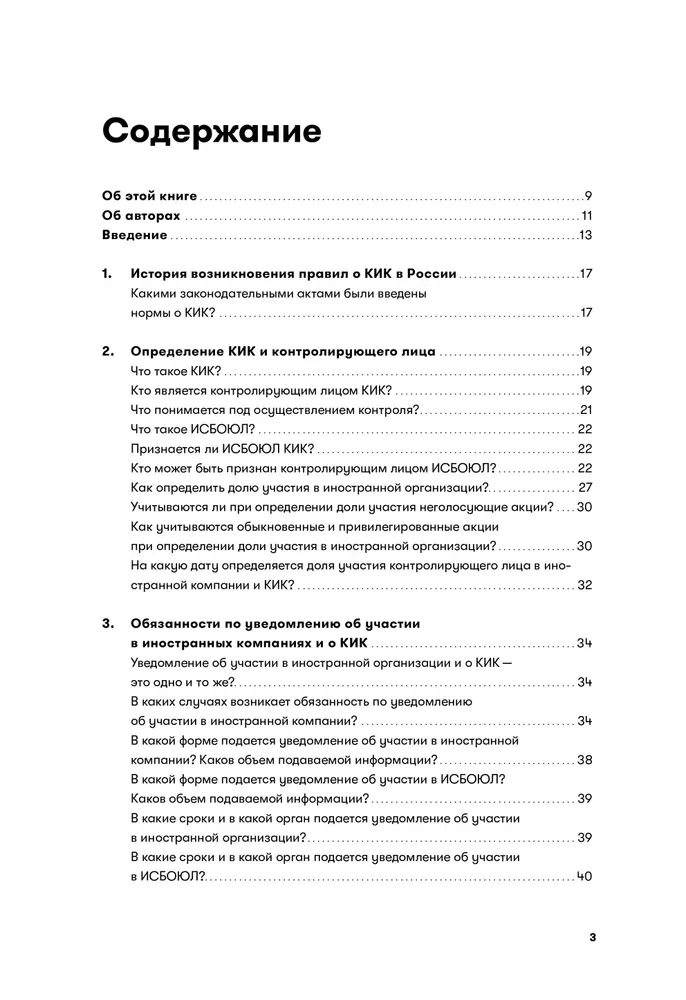

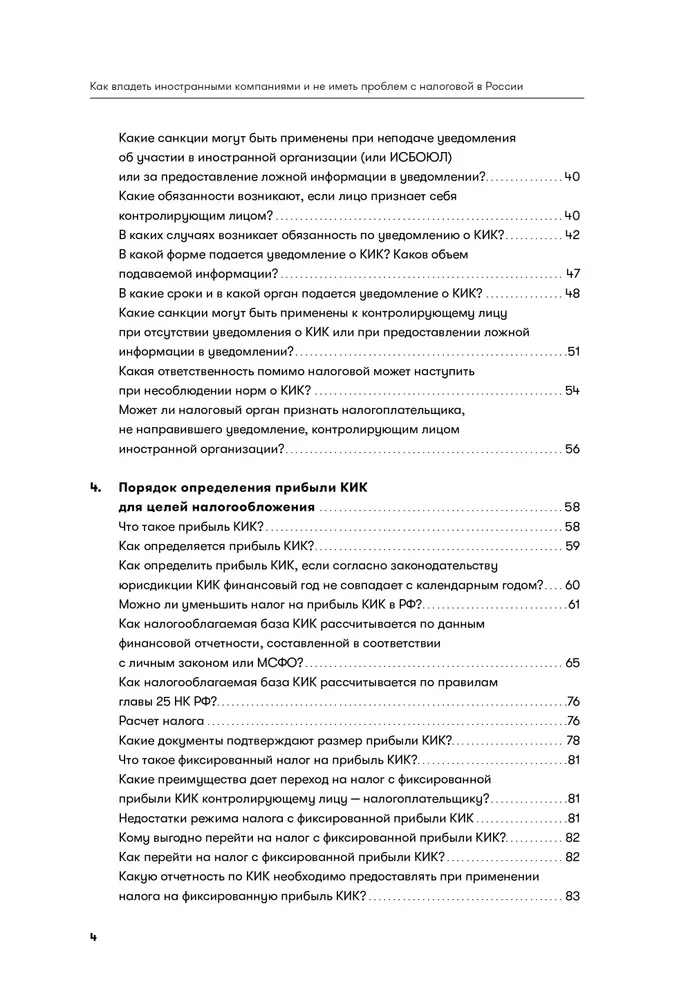

• Contains information about current changes in tax legislation, examines the practice of...

its application, and offers answers to relevant questions from professionals in the offshore business.

• The guide is supplemented by an overview of the rules regarding controlled foreign companies in the most sought-after jurisdictions, as well as a section on the peculiarities of working with controlled foreign companies under sanctions.

Since the release of the first edition in 2019, significant changes have occurred in both Russian and international tax legislation, the exchange of tax and financial information has intensified, and the sanctions policy has seriously changed the rules for conducting international business, affecting even such previously seemingly unshakeable principles as the right to apply international tax benefits and the freedom of capital movement.

Specialists at GSL Law and Consulting examine various aspects of legislation in the Guide, the practice of its application, possible tax benefits, and the peculiarities of using foreign structures (companies, trusts, funds), including the use of consulting materials obtained from daily consulting activities.

The Guide to Working with CFCs accumulates and systematizes information, knowledge, and accumulated experience in taxation applicable to real economic activities, taking into account judicial practice in cases involving non-resident companies, issues of currency control, and taxation of foreign structures in their "native" jurisdictions.

Printhouse: Al'pina Pablisher

Age restrictions: 16+

Year of publication: 2024

ISBN: 9785206003123

Number of pages: 198

Size: 240х170х15 mm

Cover type: hard

Weight: 450 g

Delivery methods

Choose the appropriate delivery method

Pick up yourself from the shop

0.00 £

Courier delivery