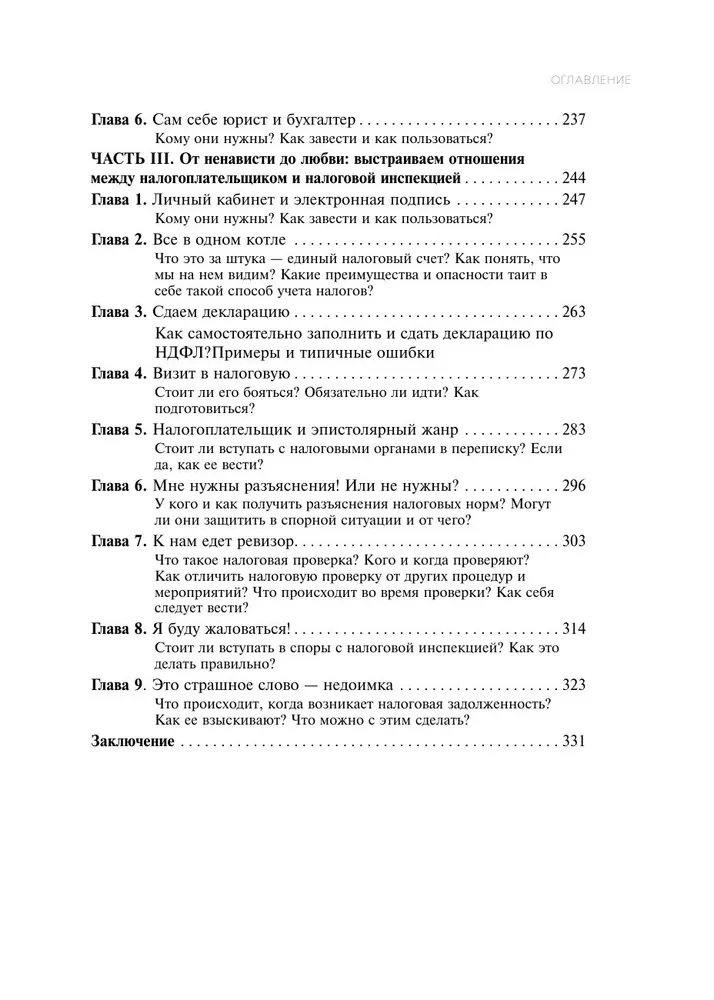

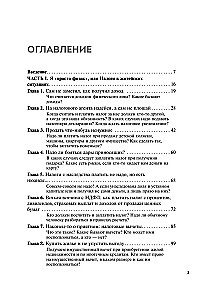

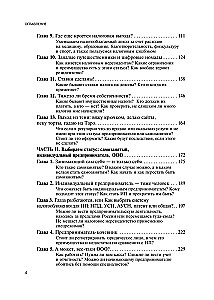

How to Tame Taxes. A Guide to the World of Taxes for Those Who Earn, Spend, and Plan to Start a Small Business

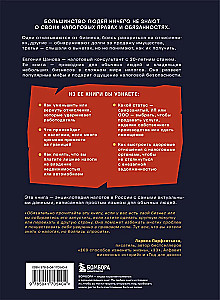

Most people know nothing about their tax rights and obligations. Some refuse to start a business, afraid of going bankrupt due to contributions, others discover debts from selling property, and some have heard about deductions but do not understand how... to obtain them. Evgenia Tsanova is a tax consultant with 20 years of experience. Her book is a guide for ordinary people and small business owners in the complex world of taxes. It will dispel popular myths and provide a sense of tax security. From her book, you will learn: - how to reduce or reclaim contributions withheld by the employer? - what happens to taxes if you spend a lot of time abroad? - how to understand if you are paying excess taxes on property or vehicle ownership? - what status - self-employed, individual entrepreneur, or LLC - to choose in order to sell services, products of your own production, or rent premises - how to build a healthy relationship with tax authorities to avoid sudden debts This book is an encyclopedia of taxes in Russia with the most relevant data, written in simple language for ordinary people.

Author: Евгения Цанова

Printhouse: Eksmo

Series: Просто о финансах

Age restrictions: 12+

Year of publication: 2024

ISBN: 9785041705404

Number of pages: 336

Size: 220x165x23 mm

Cover type: твердая

Weight: 578 g

Delivery methods

Choose the appropriate delivery method

Pick up yourself from the shop

0.00 £

Courier delivery